Payment Orchestration vs Payment Gateway Know the Difference

In the world of online payments, terms like payment orchestration and payment gateway are Mostly used. While they are both important for processing payments, they work in different ways. Knowing their differences can help you choose the best solution for your business. Let’s discuss it in simple terms.

What is a Payment Gateway?

A payment gateway is like a bridge that connects your customer's payment method (credit card, wallet, etc.) to your bank. It makes payments are processed safely and quickly. Many businesses use free payment gateways for WordPress to simplify their setup.

Key Features of Payment Gateways:

- Authorization: Checks if the customer has enough money and approves the payment.

- Encryption: Keeps customer payment details safe during the transaction.

- Settlement: Transfers the payment to the merchant’s account.

- Integration: Works well with platforms like Shopify, WooCommerce, or even free payment gateways for WordPress, which are commonly offered by a professional WordPress development company.

Example: PayPal, Stripe, and Razorpay are well-known free payment gateways and popular among small businesses for easy payment processing.

What is Payment Orchestration?

Payment orchestration is a more advanced system. It helps businesses manage and use multiple payment gateways and methods from one platform. This is especially helpful for companies that operate in many countries or handle high transaction volumes.

Key Features of Payment Orchestration:

- Gateway Management: Connects multiple payment gateways in one system for seamless payment processing.

- Smart Routing: Sends payments through the best or cheapest gateway, optimizing costs for the business.

- Global Coverage: Supports many currencies, regions, and payment methods, offering flexibility to global businesses.

- Fraud Prevention: Includes tools for fraud management and compliance with international regulations.

- Analytics: Provides detailed insights on transactions for better decision-making.

For businesses working with platforms like WordPress, WordPress API development services can enhance payment integration by enabling smooth communication between systems.

Example: A payment orchestration platform might use PayPal for U.S. payments, Stripe in Europe, and local providers in Asia to ensure smooth payments orchestration across regions.

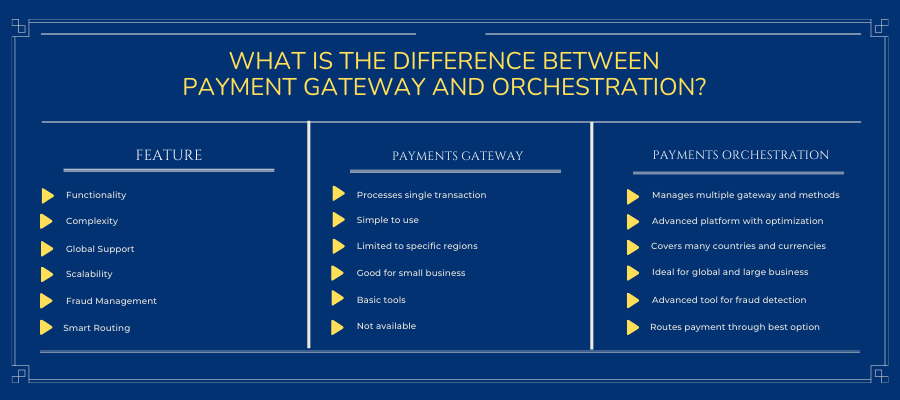

What is the Difference Between Payment Gateway and Orchestration?

The key difference lies in their functionality:

- A payment gateway make easy individual transactions, while payment orchestration platforms manage multiple gateways and optimize transactions.

- Payment gateways are great for small businesses, while orchestration platforms offer advanced features like smart routing and fraud management.

Which One Should You Choose?

- For Small Businesses: A payment gateway, such as a free payment gateway, is perfect for basic payment needs.

- For Large Businesses: Companies with global customers and higher transaction volumes should consider payment orchestration platforms for easy to use and effective.

Why Payment Orchestration is Gaining Popularity

With the rise of global e-commerce, businesses need to handle various payment methods and currencies. Payments orchestration helps smooth the process by reducing failed transactions, optimizing costs, and controlled.

It also provides tools for fraud management and detailed analytics, making it a powerful choice for businesses aiming to scale.

For businesses using WordPress, integrating a WordPress API development service can further smooth payment systems and improve user experience.

To Wrapup:

Payment gateways are great for small businesses that need simple solutions, while payments orchestration platforms offer advanced tools to manage multiple payment gateways and optimize payments globally. By understanding these systems, you can improve your payment processing and deliver a better experience to your customers.